SA Property - 3 Steps to Buying your First Home

“Happiness is… buying your first home” (Anon)

Few things in life can compare to the joy of finally crossing the threshold of your first home. If you are like most of us, you have been dreaming of this day for years and years – it has finally arrived!

The financial bonus of course is that you have probably just made one of the most important investment decisions you will ever make.

Here are some guidelines to help you make a wise decision on both counts -

Step 1: What’s your price range?

First step is to work out what price range you are looking at, and that’s a function of deciding how much you have on hand and how much you will be able to pay every month for the privilege of owning your own home.

And whilst it’s always tempting to over-commit yourself, over-confidence as to how far you can stretch your budget is a mistake likely to end in tears. So keep reminding yourself to be realistic when you work out what your new monthly costs will be.

Checking your credit score at this stage will also avoid any unpleasant surprises when you come to apply for a bond.

What will your monthly costs be?

Your bond repayments: Your big monthly expense is likely to be your monthly bond instalments, so start off by using one of the many online calculators to establish how much you will be able to borrow on a home loan without breaking your budget when it comes to the repayments. Think carefully about how happy you will be with the lifestyle you can afford after paying your bond every month.

When you first apply for a bond shop around for the best interest rate and, with rates already starting to rise again, be absolutely certain that even if interest rates do at some stage return to the high levels we have seen in the past, you will always be able to afford the monthly repayments.

Get a bank pre-approval here - with today’s restrictions on credit grantors when it comes to responsible lending practices, it will help you gauge affordability. And as a bonus, it gives you a great negotiating tool when you move on to the offer stage!

Other monthly costs: Then – and this is an important aspect easily overlooked in the excitement of your purchase - remember to factor in all the other monthly expenses that come with property ownership. Think homeowner’s insurance, rates/taxes/levies, home security services, services like electricity and water and the like.

When budgeting for home and garden maintenance costs, include a provision for long-term expenses like repainting, roof repairs and so on.

How much cash will you need upfront?

- The cash deposit: Unless you can pay the full purchase price in cash, you will need to raise a home loan (bond). And although you might perhaps qualify for a 100% bond, most first-time buyers will need to pay at least a 5% to 10% cash deposit.

- Bond costs: Your bond needs to be registered in the Deeds Office by the bank’s attorneys. Provide for both the registration costs and the bank’s initiation fee.

- Transfer costs: Unless your sale agreement provides otherwise (very unlikely), you will be paying the transfer costs to the conveyancer (“transferring attorney”) attending to the registration of the property into your name in the Deeds Office.

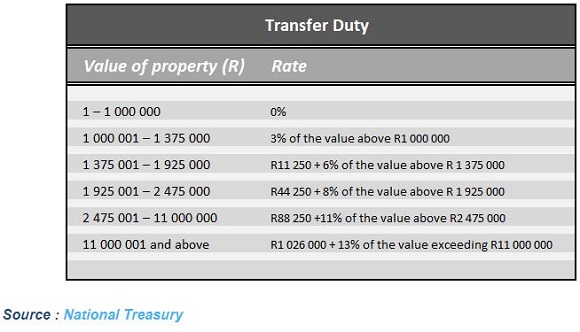

- Transfer duty: Unless there’s VAT on the sale, the sale agreement will almost certainly also require you to pay the transfer duty, which is a government tax on property sales. No duty is payable on a property valued up to R1m and a sliding scale applies to houses above that threshold as per the table below –

Transfer Duty is payable at the following rates on transactions which are not subject to VAT:

Acquisition of property by all persons:

- Moving costs: This step is easily overlooked, but your total moving costs can turn out to be much higher than expected when you include all the “hidden” expenses like redecorating, furnishing, new internet connections and so on.

- Keep a contingency fund: It always seems to happen – no matter how carefully you plan your expenses, something unforeseen pops up. Or things cost more than you budgeted for. Or there’s a “black swan” emergency. Check that you have some ready cash to deal with these speedbumps.

Step 2: House hunting!

You know your price range, so on now to the really exciting part of all this – finding your dream house.

Here’s a checklist to get you started -

- Location, location, location: What area/s will you concentrate on? Where do you want to live? What sort of lifestyle are you after? Do you plan to work from home? Do you need to find a pet-friendly area? What amenities do you want close by? Are there good schools in the vicinity? Research the area – what are average selling prices in the suburb and is your budget up to it? Do houses in the area have a history of good value growth? What are crime levels like?

- What sort of house are you looking for? How many rooms do you need? Will your needs change in the future? Do you need a home office? A granny flat? A big garden? A pool? The list of questions to ask yourself here is endless, just be sure to think of the long term as well as of your immediate wants and needs. And do bear in mind that sooner or later you will want to re-sell, so think now about whether the features you are looking for now will also appeal to other buyers down the line.

- Searching: With your price range and target area identified, the “thrill of the hunt” is at last upon you! Online searches are increasingly popular but choose whichever channel you are comfortable with. Your lawyer will have valuable knowledge of the local housing market and may refer you to a trusted estate agency or two.

- If buying into a community scheme: Check what Rules and Regulations you are letting yourself in for – you will be held to them. Make sure that the Homeowners Association or Body Corporate’s finances are sound (ask for audited financials and management accounts). Ask about any special levies or other planned expenditure on the horizon (get it in writing). Take professional advice in any doubt.

- Plans, defects and the rest: Although the new Property Practitioner’s Act requires the seller to make disclosure of any defects or deficiencies (in a written document annexed to the sale document – study it carefully!), it is still advisable to do your own homework. Ask for copies of approved building plans (check for any unlawful structures or deviations from plan), look for and ask about defects like leaking roofs, problem foundations etc - consider getting a full professional report unless you are very sure of your own abilities in this regard.

Step 3: Putting in your offer

- Now that you’ve found your dream house it’s time to put your offer in. Excitement mounts – will the seller accept, or perhaps counter-offer? You can’t wait to find out. You are presented with an Offer to Purchase (sometimes titled as a Deed of Sale), a pen and a cheerful “just sign here, we’ll do the rest”.

- Take no chances here! Have the paperwork professionally checked before you commit to anything. Ask also for Deeds Office and other searches for anything that may affect your decision-making - restrictive title deed conditions, servitudes (giving other people rights over your property), alterations carried out without municipal plans and approval, zoning conditions and so on.

- Make sure that any verbal undertakings or disclosures given to you are properly recorded in the agreement – what counts is what’s in writing!

Provided by Anthony Whatmore & Company

© DotNews. All Rights Reserved.

Disclaimer

The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.