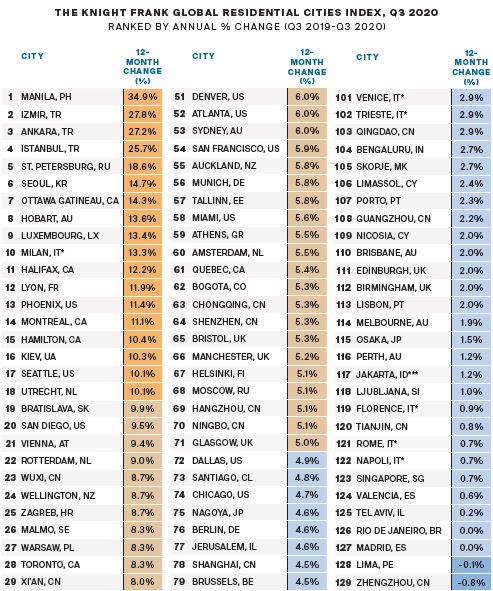

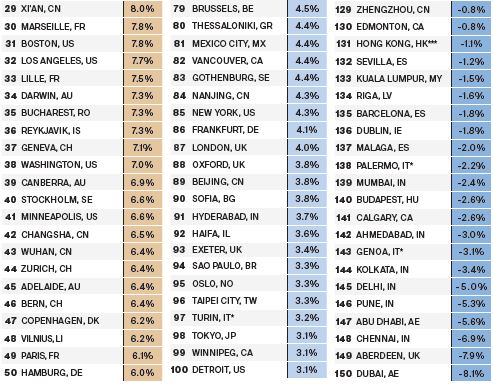

International Property - Global Residential Cities Index Q3 2020

HEADLINES

- Manila CITY WITH THE HIGHEST RATE OF PRICE GROWTH IN THE YEAR TO Q3 2020 (35%)

- 4.7% AVERAGE ANNUAL GROWTH ACROSS 150 CITIES

- 15% THE PERCENTAGE OF CITIES REGISTERING ANNUAL PRICE DECLINES IN THE YEAR TO Q3 2020

- 18 THE NUMBER OF CITIES REGISTERING DOUBLE-DIGIT ANNUAL PRICE GROWTH IN Q2 2020 TO Q3 2020

- 7% THE AVERAGE RISE IN PRICES ACROSS NORTH AMERICANCITIES IN THE YEAR TO Q3 2020

The Index’s annual rate of growth increased between Q2 and Q3 2020, from 4.1% to 4.7% and 18 cities saw prices rise by more than 10% year-on year, up from 16 in Q2 2020.

Far from the death of the city this suggests demand has proved resilient during the pandemic with few discounted or distressed sales.

Record low interest rates, huge fiscal stimulus measures as well as a release of pent up demand in Q3 are behind the uptick in price growth, and with travel restrictions during this period buyer demand was largely domestic in nature.

Emerging markets are leading the way with Manila witnessing stellar price growth of 35% year-on-year. Banks in the Philippines are reporting strong demand for high-end projects and an increase in construction and labour costs. In Turkey, the cities of Izmir (28%), Ankara (27%) and Istanbul (26%) occupy second, third and fourth place respectively with St Petersburg (19%) completing the top five.

Despite 20 rounds of cooling measures in the last few years, Seoul continues to register annual price growth of 15%, buoyed by its quick economic rebound and a degree of speculative activity.

Four Canadian cities (Ottawa, Halifax Montreal and Hamilton) now sit in the top 20 with news this month that Canada is considering a countrywide foreign buyer tax. US cities have also risen up the rankings with three making it into the top 20 (Phoenix, Seattle and San Diego).

Some 15% of cities saw prices decline in the year to Q3 2020, with cities in India, Spain and the UAE well represented.

All eyes are now on Q4 data when we may see greater regional variations emerge. Europe may see price growth moderate in Q4 due to recent lockdowns, before a further of release of pent up demand in Q1 2021, whilst sales and prices in some parts of Asia may start to gain traction.

Courtesy:Knight Frank

CONTACT FOR FURTHER INFORMATION

Sales enquiries

Mark Harvey

+44 20 7861 5034

Research enquiries

Kate Everett-Allen

+44 20 7167 2497

Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. © Knight Frank LLP 2020. Terms of use: This report is published for general information only and not to be relied upon in any way. All information is for personal use only and should not be used in any part for commercial third party use. By continuing to access the report, it is recognised that a licence is granted only to use the reports and all content therein in this way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without prior written approval from Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.