Property Research - Global Residential Cities Index Q2 2020

HEADLINES

- Izmir - The City with the Highest Rate of Annual Growth in the year to June 2020 (28%)

- 3.4% - Average Annual Price Growth across 150 Cities

- 19% - The Percentage of Cities registering an Annual Price Decline

- 16 - The Number of Cities Registering Double-Digit Price Increases

- Stockholm - Saw Annual Price Growth Increase by 6% in the Year to June 2020

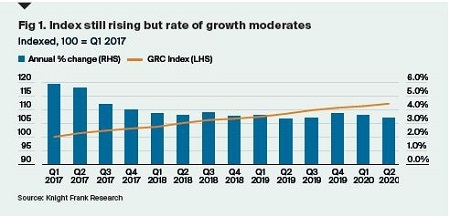

The index’s annual rate of growth declined marginally from 3.6% to 3.4% between March and June this year. Not surprising, given most housing markets were stopped in their tracks by the pandemic in the second quarter with transactions unable to complete. Nevertheless, the index is still recording growth on a par with that seen in 2018 and 2019 (Fig 1).

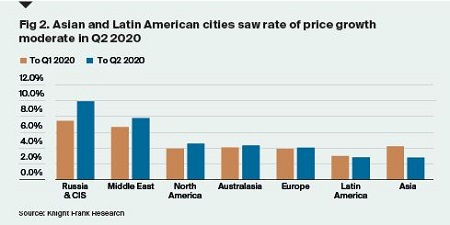

That said, there are some indications of weakening performance. Firstly, the percentage of cities seeing prices fall year-on-year increased from 15% to 19% between March and June this year. Secondly, the number of cities recording double-digit prices rises on an annualbasis declined from 20 to 16 over the samethree-month period.

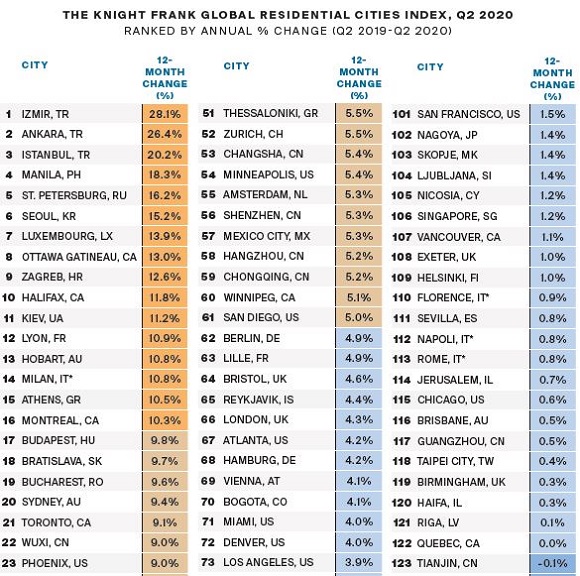

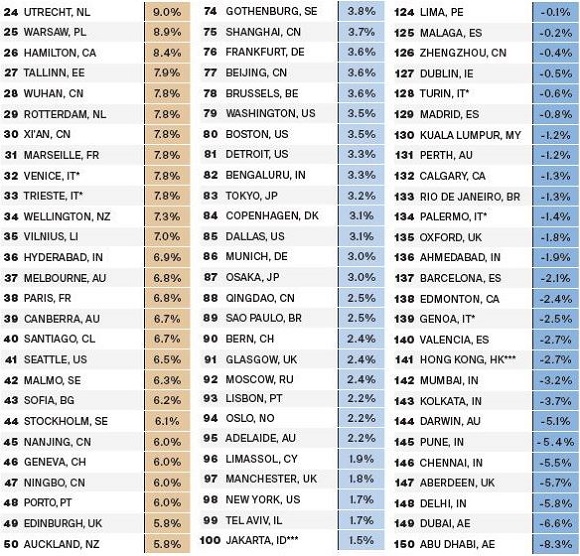

Turkish cities now occupy the top three rankings. The fundamentals of strong demand and constrained supply explain the level of growth along with a weakening lira. The population of Turkey has increased by 12 million to 83 million in the last decade alone according to the World Bank. The weak lira – now close to 7.6 to the US dollar - is also boosting demand from gulf countries.

European cities now account for two of the top ten rankings, down from four a year ago with Luxembourg the strongest performer, up 14%.

Italian cities registered price growth of 3% on average, up from 0% a year earlier, with Milan leading the way with annual growth of 11%.

Two of the three Swedish cities we track, where no formal lockdown was enforced, have seen their rate of growth increase since March. Stockholm saw annual price growth rise from 5% to 6% and Gothenburg from 2% to 4%.

Phoenix leads the US cities we track with price growth of 9%. On average, US cities have seen their annual rate of growth drop from 4.2% in March to 3.9% in June.

What we’ll be watching in Q3 2020:

- Any regional variations in performance

- Whether housing markets in tourist driven economies are more heavily impacted by the pandemic

- If second surges of the pandemic put a brake on sentiment, demand and hence price growth

- The extent to which supply constraints in several tier one cities insulate prices

Sales enquiries - Mark Harvey

+44 20 7861 5034

Research enquiries - Kate Everett-Allen

+44 20 7167 2497

Knight Frank Research Reports are available at knightfrank.com/research

Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. © Knight Frank LLP 2020. Terms of use: This report is published for general information only and not to be relied upon in any way. All information is for personal use only and should not be used in any part for commercial third party use. By continuing to access the report, it is recognised that a licence is granted only to use the reports and all content therein in this way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without prior written approval from Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.