Investment Opinion - Wealthy investors rank property above bonds and equities

- Property remains the most attractive of the traditional asset classes, with 78% of ultra-high-net-worth-individuals planning to increase or maintain their allocations, ahead of bonds (68%) and equities (62%)

- 24% of ultra-high-net-worth-individuals plan to invest in commercial property, up 3% on last year

- UK remains the number one destination for overseas investment

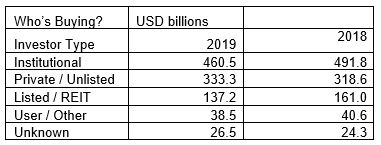

London, UK – Knight Frank’s recently launched Wealth Report 2020 reveals that private capital was responsible for $333bn of commercial real estate purchases in 2019, a 5% rise on the previous year.

Responding to the global real estate adviser’s annual Attitudes Survey, ultra-high-net-worth-individuals (UHNWIs) confirmed that property remains the most attractive asset class when compared to traditional equities and bonds, due to its relative stability and higher returns.

Of those surveyed, 78% are set to increase or maintain their current allocations to property, ahead of bonds and equities, which saw 68% and 62% of respondents seeking to increase or maintain investment, respectively.

Whilst 24% of global UHNWIs plan to invest in commercial property domestically, significant amounts of capital is set to be allocated to cross border purchases in the year ahead. Notably, 32% of wealthy investors from the Middle East and 24% from Latin America are targeting overseas commercial property opportunities.

The office sector remains the primary target for private capital investors, with healthcare and hotels and leisure following closely in second and third, as the market is seeing investors looking to alternative property types in the hunt for yield, return and diversification. Structural change and uncertainty in other core sectors is prompting investors to reallocate funds.

The number of UHNWIs – those with $30 million or more in net assets – rose by 6% in 2019, taking the total to more than 513,200.

William Mathews, head of capital markets research, Knight Frank, said: “In 2019, we saw an increase in the amount of private capital investing in global real estate, rising 5% from $318.6bn in 2018. At a time of low and falling yields on competing assets, investors are turning to commercial real estate as a way to drive returns and enhance portfolio diversification.

“Investors from the Middle East, Europe and Latin America have the most appetite for investing overseas and the UK looks set to receive the lion’s share.

“Whilst offices remain a primary target for private capital, the once regarded ‘alternative’ sectors are coming to the fore, with hotels, healthcare, and retirement housing attracting $37bn in the past year alone. This is a trend we expect to see continue as these sectors mature.”

Source: Knight Frank, Real Capital Analytics

Courtesy: Knight Frank

For more information, please visit: http://www.knightfrank.com/wealthreport

For further information, please contact: [email protected]

Notes to Editors

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank has more than 19,000 people operating from 512 offices across 60 territories. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit knightfrank.com