International Research - UK House Price Forecast

Residential Research - UK Residential Market Forecast

Headlines Dec 2017

- UK house price growth has been slowing since the summer of 2014, although the annual change remains positive

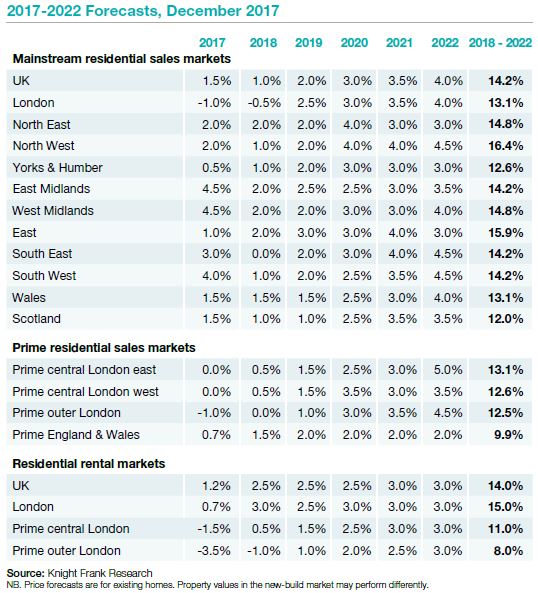

- Price growth across the UK is expected to be 1.0% in 2018, reaching 14.2% cumulatively between 2018 and 2022

- In London, prices are forecast to fall by 0.5% in 2018, but cumulative price growth over the next five years is positive at 13.1%

UK HOUSE PRICE FORECAST

UK house price growth has moderated from recent peaks, although markets remain highly localised.

The momentum in house price growth is slowing in many parts of the country, and we expect price rises to remain muted overall next year amid increased economic and political uncertainty in the run-up to Brexit and amid more muted forecasts for wage growth. The market is localised and we see slightly stronger growth in the Midlands, East of England and the North West, a continuation of the trend that has emerged this year.

Once the Brexit deal is completed, we forecast rising momentum across the market, with price growth reflecting this in many locations. The variations currently observed in the prime housing markets in London and beyond are set to continue, and we explore this more fully in our blog.

The UK may now be entering a period of interest rate rises, but even so, we expect rates to be low compared to long-term norms by the end of the forecast period. While development levels are rising across the country, the shortage of new homes is unlikely to be fully reversed in the coming years, and that will underpin pricing.

On the other hand, factors such as deepening affordability pressures and property taxes, will continue to weigh on pricing.

Methodology Statement:

House price forecasts are based upon time series regression analysis of relevant statistically significant macro-economic variables adjusted in-house to encompass externalities such as likely risk factors. The forecast uses the Nationwide House Price Index as a base. Our forecasts assume a Brexit deal, but with a two year transitional period.

RISK MONITOR

Our risk score combines the likelihood of the following scenarios happening, and their impact. The score illustrates the chances that such a scenario results in pricing moving away from our central forecast

Risk: Brexit

Scenario: An unfavourable deal for the UK, or prolonged uncertainty past 2019. As well as wider economic implications, the lack of a deal could impact London’s status as a global financial centre.

Risk: Political Upheaval

Scenario: The UK Government undergoes a prolonged period of instability, raising the prospect of another General Election. This would undermine economic and consumer confidence

Risk: Interest Rates

Scenario: Interest rates rise more quickly than expected.

Risk: UK Economy

Scenario: UK economic growth underperforms against expectations.

Risk: Geo-Political Factors

Scenario: Rising geo-political tensions cause a global economic slowdown, affecting the UK economy

Risk: Property Tax Changes

Scenario: After a series of changes to property taxes, policymakers implement more in purchase taxes. Any additional charges could curb activity.

NEW-BUILD MONITOR

While the new-homes market faces similar challenges to the resales market, there are a number of additional complexities to consider. Here, we identify key areas which could have the biggest impact on supply and the government’s aim to address wider affordability concerns by building more homes.

Housing Delivery

UK: The number of net additions in England has risen 62% over the last five years, however total new-build supply needs to rise by an additional 28% to reach the target of 300,000 net additions a year. New delivery has been boosted in recent years by permitted development rights, and the one-off ‘boost’ from the change of rules around conversions and change of use may not re-occur. There is still a shortage of new homes in areas where they are most needed.

London: Net supply rose to 39,560 in 2016/17, compared to the 66,000 new homes a year needed in the capital. However, in some areas on the edges of central London, the issue of oversupply in some price brackets is worth monitoring.

Planning

UK: The planning process is still challenging in many Local Authorities. The Chancellor outlined more suggested changes to try and streamline the process in the Budget, including measures to speed up the discharge of planning conditions.

London: New Affordable Housing rules are causing some short-term delays in construction starts as developers review scheme economics

Labour

The industry is looking for certainty on supply of labour from overseas amid Brexit negotiations. An increased move to more modern methods of construction will change the requirements for skills in some instances, but more work is needed to increase supply of skilled labour across all sectors of the construction industry.

Policy

Additional policy changes not specifically designed to boost development could constrain activity as developers adjust. A stable policy environment will underpin raised levels of delivery.

Help to Buy Equity Loan

An additional £10bn has been pledged, but clarity is still needed on what will happen post-2021.

Funding

The cost of private-sector funding for developers (especially smaller SMEs) is becoming a barrier to development, although the Chancellor has boosted funding for the Home Building Fund to try and help address this issue.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Liam Bailey - Global Head of Research

+44 20 7861 5133

Gráinne Gilmore - Head of UK Residential Research

+44 20 7861 5102

Tom Bill - Head of London Residential Research

+44 20 7861 1492

Oliver Knight - Associate

+44 20 7861 5134

Important Notice

© Knight Frank LLP 2017 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.