Residential Research - Global House Price Index

GLOBAL HOUSE PRICES RECORD FIRST FALL IN TWO YEARS

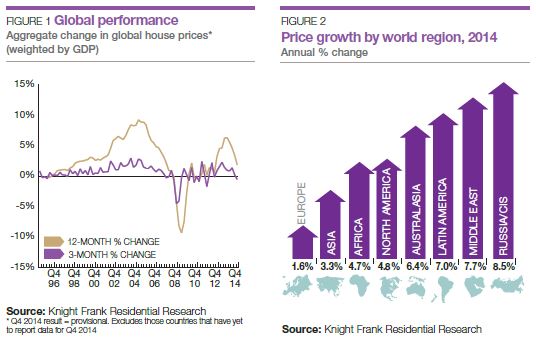

Knight Frank’s Global House Price Index registered a fall in prices in the final quarter of 2014, its first quarterly decline in over two years. The latest data underlines not only the fragility of the global economic recovery but the extent to which it is filtering through to buyer sentiment. Kate Everett-Allen examines the latest figures.

Results for Q4 2014

- The Knight Frank Global House Price Index declined by 0.6% in the final quarter of 2014

- Ireland leads the rankings with prices rising 16.3% in 2014

- Ukraine was the only country to record a double-digit price fall in 2014

- Europe was the weakest-performing world region in 2014, with prices rising on average by 1.6%

- Hong Kong’s mainstream property market is outperforming its luxury segment as buyers target smaller units due to affordability constraints

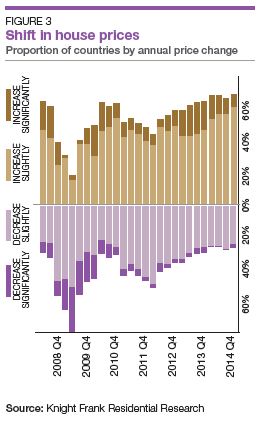

The Global House Price index, which is weighted according to each country’s GDP, rose by 1.8% in 2014 but slipped by 0.6% in the final quarter of the year. This represents the index’s weakest performance since the third quarter of 2012.

The final quarter of 2014 saw a turbulent political and economic landscape emerge. The global economy grew by 3.3% as opposed to the 3.8% forecast, oil prices slumped, tensions between Greece and the Eurozone re-emerged, the outlook for the Chinese economy weakened and the Ukraine crisis intensified. The macro picture did little to boost the confidence of homeowners.

Ireland leads the rankings, with prices ending the year 16% higher but average prices remain 38% below their peak having fallen 51% from peak (Q3 2007) to trough (Q1 2013).

Five countries recorded double-digit price rises in 2014, Turkey and Hong Kong amongst them. Ukraine, meanwhile, was the only county to record a doubledigit price fall over the 12-month period, down 17%.

Prices in Hong Kong’s mainstream housing market rose by nearly 12% in 2014 whilst the city’s luxury segment saw largely flat price growth (1.1%). The mainstream market is now dominated by small units priced below HK$4m, which are seeing stronger demand due to affordability constraints. Meanwhile, larger properties incur heavy double stamp duty rates of up to 8.5%.

Although the rate of global annual growth declined between 2013 and 2014 – from 6.3% to 1.8% – the gap between the top and bottom ranked countries shrank from 61 percentage points at the end of 2013 to 33 at the end of 2014, suggesting that there is a degree of convergence taking place amongst global housing markets.

The outlook for 2015 is set to be dominated by two monetary policy decisions; one past, one future. Firstly, the extent to which the ECB’s new QE programme will stimulate the Eurozone’s housing markets and secondly, the timing of the US Federal Reserve’s rate rise. The focus is not just on the resilience of the US market and the extent to which it absorbs the rise but the impact on those markets whose currencies are pegged to the dollar.

DATA DIGEST

The Knight Frank Global House Price Index established in 2006 allows investors and developers to monitor and compare the performance of mainstream residential markets across the world. The index is compiled on a quarterly basis using official government statistics or central bank data where available. The index’s overall performance is weighted by GDP and the latest quarter’s data is provisional pending the release of all the countries’ results.

RESIDENTIAL RESEARCH

Liam Bailey, Global Head of Research

+44 20 7861 5133

Kate Everett-Allen, International Residential Research

+44 7876 791630

PRESS OFFICE

Astrid Etchells

+44 20 7861 1182

© Knight Frank LLP 2015 - This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.