SA Investment Update - Dividends play a vital role for investors

The ability of a company to pay out steady or growing dividends is often a sign of a healthy business and a good long-term investment. These dividend payments can play an important role for investors.

A dividend is a payment made by a company to its shareholders and typically represents a portion of a company’s earnings that the directors of a business have decided to pay out and not reinvest back into the company.

The benefits of dividends are outlined below:

1. A source of income

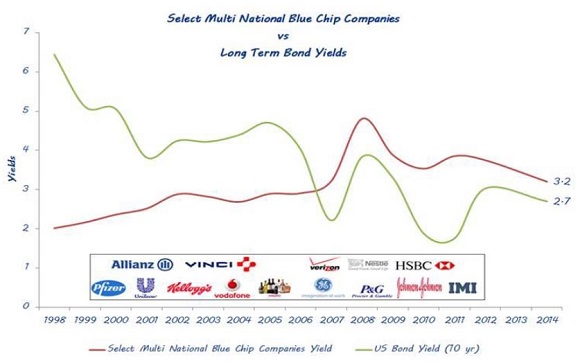

Dividends provide investors with cash flows which can be used to fund a lifestyle or they can be reinvested. It is interesting to note that in first world markets at present, dividend yields of multinational blue chip companies are higher than cash and bond yields, making them an excellent source of current income.

The chart below compares the yields of a selection of multi-national blue chip companies to the 10-year US government bond yield:

2. Inflation protection

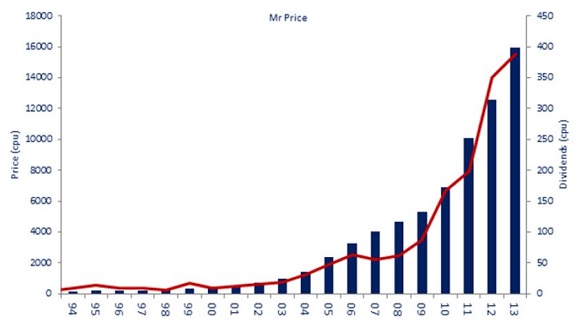

Companies that pay dividends provide investors with an effective inflation hedge. Take, for example, an investment made in Mr Price. In 1994 a R100,000 would have bought the investor 66 000 shares in the company. Those shares would have paid the investor approximately R2 100 worth of dividends in the first year. In 2013 that same investor would have received approximately R263 000 worth of dividends from the same number of shares. This increase in dividend income equates to an average annual income growth rate of 28.5% per annum for the past 20 years. This growth exceeded average inflation over the corresponding period by 22.1% per annum.

It is also important to note that the value of a company increases at the rate at which its profit grows. In the same way, the value of an investment grows over time at the rate at which its income grows. Mr Price’s average annual capital growth over the last 20 years has been 26.4% which corresponds with the company’s 28.5% average annual growth in dividend over the same period.

The chart below illustrates Mr Price’s dividend and share price growth since 1994:

3. Companies which reliably grow their dividend tend to outperform over time

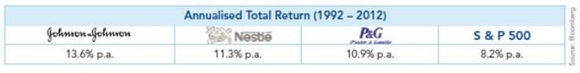

Many investors think of reliable dividend payers as stodgy, uninteresting companies that will produce mediocre returns. This is far from being the case. Studies have shown that companies which pay and grow their dividends outperform the market over the long term.

The table below highlights the annualised total return of Johnson & Johnson, Nestlé, Proctor & Gamble and the S & P 500 index for the past 20 years:

Possible explanations for why reliable dividend payers outperform include:

- The inherent optimism of people which drives investors to overpay for exciting and high-risk companies with volatile dividends, and underpay for certainty;

- The large percentage which dividend income contributes to an investor’s total return over the long term; and

- The fact that reliable dividend growth typically indicates that a company has a dominant brand, a strong balance sheet and a high degree of confidence that its earnings and cash flows will continue to support future payments.

4. Managing tax

In South Africa, dividends are taxable in the hands of the investor at flat rate of 15%. This is an advantage for high net worth Individuals in higher tax brackets.

5. Volatility

Investing in companies that pay reliable dividends helps to reduce volatility: when company share prices have declined, investors will still receive dividend payments.

At Marriott we fully recognise the important role dividends can play for investors in achieving their investment objectives. Our equity fund, the Marriott Dividend Growth Fund, is managed to provide investors with a high level of dividend income that will grow faster than inflation over time. By investing in fundamentally-sound, JSE-listed stocks with the ability to pay consistent dividends, the fund has delivered a reliable and inflation-beating income stream to its investors over the past decade with distribution growth of 13.2% each year, exceeding inflation by approximately 7.7% per annum.

This release has been issued on behalf of Marriott, the Income Specialists

For more information, please contact:

Marriott:

Bronwen Matthews, Head of Marketing:

031 765 0736 – direct

031 765 0700 – switchboard

Tamryn Kelly, Marriott Marketing:

031 765 0766 – direct

031 765 0700 – switchboard

Shirley Williams Communications

Shirley Williams: 031 564 7700 or 083 303 1663

Gillian Findlay: 082 330 1477

About Marriott, the Income Specialists

Marriott aims to reduce financial anxiety of retired investors by offering Solutions for Retirement, using an Income Focused Investment Style which produces reliable and consistent monthly income.