House price indices - Middle-segment house price growth slows down further

Year-on-year growth in the average value of homes in the middle segment of the South African housing market continued to slow down in November 2013. Base effects and slowing month-on-month price growth remain important factors contributing to the downward trend in year-on-year price growth. Economic conditions and trends in household finances and consumer confidence are also affecting the property market and playing a role in price growth. These trends in house price growth are according to the Absa house price indices, which are based on applications for mortgage finance received and approved by the bank in respect of middle-segment small, medium-sized and large homes (see explanatory notes).

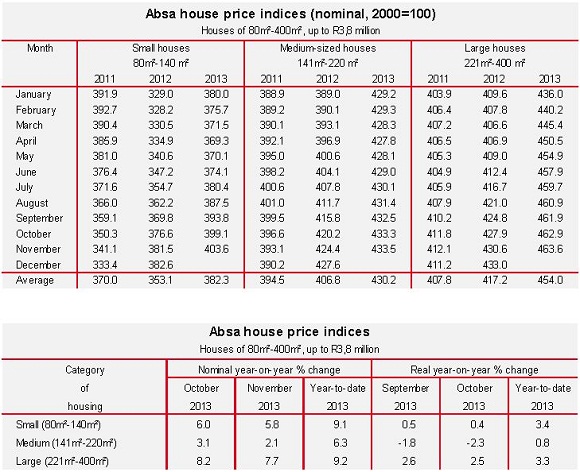

Nominal year-on-year price growth slowed down further in all three categories of housing in November from October this year. The weighted average price growth of the abovementioned three categories of housing was lower in November, with real price growth, i.e. after adjustment for the effect of inflation, below 3% year-on-year (y/y) in October.

The average nominal value of homes in each of the three middle-segment categories was as follows in November 2013:

- Small homes (80m²-140m²): R804 000

- Medium-sized homes (141m²-220 m²): R1 083 000

- Large homes (221m²-400m²): R1 689 000

Real economic growth remained relatively low up to the third quarter of 2013, with full-year growth expected to be less than 2%. Consumer price inflation tapered off to 5,5% y/y in October from 6% y/y in September and 6,4% y/y in August, mainly as a result of a drop in fuel prices and lower food price inflation. However, domestic fuel prices edged up again in early December on the back of rand exchange rate and international oil price movements, which will counter the recent downward trend in inflation. Consumer price inflation is forecast to average between 5,5% and 6% next year. Interest rates are at a 40-year low and are forecast to stay at current levels before rising in the third quarter of 2014. Low lending rates will keep debt servicing costs under control, while the household debt-toincome ratio is expected to remain above the 70% level.

Many households are still experiencing some financial strain, with inflation continuing to erode spending power. Growth in employment, real household disposable income and consumption expenditure remains low, while the savings ratio is not improving. Consumer credit-risk profiles deteriorated somewhat further in the third quarter of the year, impacting the accessibility of credit. Against the background of these developments, consumer confidence remains around a 10-year low in the fourth quarter of the year.

Single-digit house price growth is forecast for 2014, based on trends in and the outlook for the economy, household finances and consumer confidence. Expectations regarding nominal house price growth and consumer price inflation will result in relatively low real house price inflation in 2014.

Courtesy: ABSA Bank

![]()

Compiled by: Jacques du Toit - Property Analyst Absa Home Loans

Tel +27 (0)11 350 7246

[email protected]

www.absa.co.za

Explanatory notes:

The Absa house price indices, available back to 1966, are based on the total purchase price of houses in the 80m²-400m² size category, priced at R3,8 million or less in 2013 (including improvements), in respect of which mortgage loan applications were received and approved by Absa. Prices are seasonally adjusted and smoothed in an attempt to exclude the distorting effect of seasonal factors and outliers in the data. As a result, the most recent index values and price data may differ from previously published figures.

The information in this publication is derived from sources which are as accurate and reliable, is of a general nature only, does not constitute advice and may not be applicable to all circumstances. Detailed advice should be obtained in individual cases. No responsibility for any error, omission or loss sustained by any person acting or refraining from acting as a result of this publication is accepted by Absa Bank Limited and/or the authors of the material.