The two-speed UK propety market: North-South divide widens for residential development land

Knight Frank English Residential Development Land Index, Q3 2011 Results

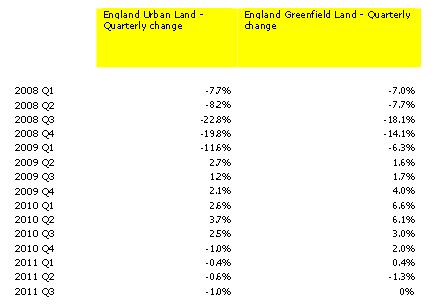

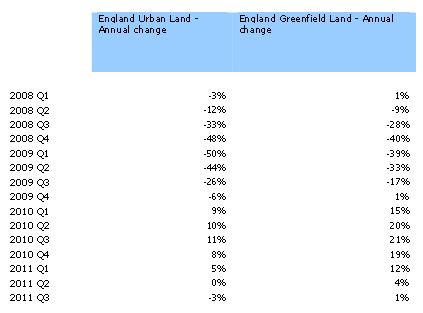

- The pace of growth in the value of brownfield land in urban areas across England slipped in Q3 at the fastest pace since the end of last year, resulting in the first annual decline in prices since late 2009

- Prices of English greenfield land remained unchanged on the quarter after a 1.3% drop in Q2, while annual growth slowed to 1%

- Supply is beginning to outpace demand in some areas, although competition remains strong for the very best sites

- Average English residential land values are more than 40% lower than their peak at the end of 2007.

Grainne Gilmore, Head of UK Residential Research at Knight Frank, says:

“Demand for residential land remained strong for desirable locations, especially in the South of England, but slowed in the North, resulting in a slight slowdown in the overall demand for land across the country. In some marginal areas, especially in the North of England, the appetite for sites is negligible. Some sites are simply not viable given the state of the local housing market.

“Supply of land outside London rose by 9% over the quarter, while demand increased by 3%.

“The differential between the markets for land in the best locations and land which is poorly situated continues to widen, with agents reporting that the difference between demand levels and pricing can vary from road to road in some areas.

“The very best schemes, including prime sites in and around market towns, especially in the South are still attracting interest and there is stiff competition between bidders. But poorly-located land is now available at heavily reduced prices.

“Funding remains an issue, putting larger housebuilders, who have better access to credit, at an advantage.

“The economic gloom has also taken a toll on the market, particularly in regions which have seen a large rise in unemployment, as have the continued constraints in the mortgage market, with many first-time buyers cut off from accessing home loans unless they have a large deposit. The confusion over the planning regime is also having an impact on the market and will likely continue to do so until the rules become clearer.

Who is selling?

“Public sector bodies remain the primary sellers across the country, but speculative land investors and private land owners were also active during the quarter, especially in the East Midlands.

Who is buying?

“Residential developers and housebuilders remained key buyers across the UK, although housing associations also stepped up their activity in the West Midlands between June and September.

Outlook:

“Land values are expected to remain broadly stable during the year, with a modest 2% drop forecast for urban land values outside the M25. Greenfield land values are tipped to rise by 3% next year.“

Source: Knight Frank Residential Research

Courtesy: Knight Frank

For further information, please contact:

Rosie Cade, Residential Development PR Manager, Knight Frank,

Tel: +44 (0)20 7861 1068

Email: [email protected]

Gráinne Gilmore, Head of UK Residential Research, Knight Frank,

Tel: +44 (0)20 7861 5102

Email: [email protected]