Global House Price Index - prices stall or slide in half of all countries in Q1 2011

Global housing market weakens further – prices stall or slide in half of all countries in Q1 2011

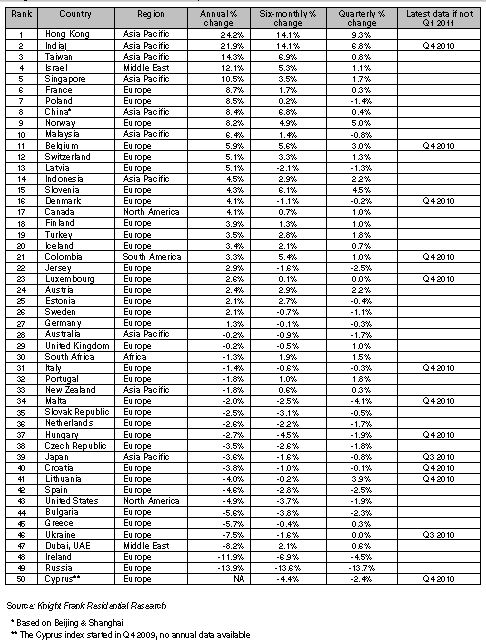

Knight Frank Global House Price Index, Q1 2011 results

Key findings:

- Global house prices increased by only 1.8% in the year to March, the lowest annual rate of growth recorded since Q4 2009

- House prices in 25 of the 50 countries included in the index remained flat or saw negative growth in the first three months of 2011, compared to only 18 countries a year earlier

- In regional terms, Asia remains the top-performing continent, recording 8.4% growth over the last 12 months. However, this is down from 17.8% a year earlier

- The weakest region was North America which saw a fall of 0.4% in values in the year to Q1 2011.

- While house prices in Europe were static in Q1, this represents an improvement on 12 months earlier when house prices on average had fallen 4.1% in the preceding 12 months

- The strongest performing countries were: Hong Kong (24.2%), where the government is fighting to pull inflationary pressures under control; India (21.9%) and Taiwan (14.3%)

Liam Bailey, Head of Residential Research at Knight Frank, comments: “Price growth, while not stalling, has faltered in Q1 2011, pointing to ongoing problems underlying the world’s housing markets. In Q4 2010 overall annual price growth stood at 3.3%. Three months later this shrank to 1.8%.

“A cursory glance at the results table would suggest it’s business as normal, with Asian countries firmly implanted at the top of the table and both Europe and North America languishing behind. But there are a few less predictable results.

“House prices in Russia, for example, fell 13.7% in the first three months of this year positioning it below Ireland in the rankings. On the other hand, France has jumped to 6th place in the rankings, up from 30th a year earlier. Sweden and Germany, by comparison, have experienced several quarters of positive growth only to fall back in Q1 2011. In most of these cases, with the notable exception of Germany, the housing market is reflecting the wider economy’s performance as well as responding to domestic policy decisions.

“In Russia the Government’s mass affordable housing programme is boosting supply and lowering the average prices throughout the country, despite the average price growing in Moscow and Saint Petersburg. House prices in France look to be mirroring the country’s improving economic scenario; GDP increased by 1.0% in Q1 2011, its highest quarterly rise since Q2 2006. Greater productivity is impacting on wages, consumer spending is up and likewise property demand.

"Globally, the slowdown in annual price growth to 1.8% is largely attributable to the poor performance in the first three months of this year. In Q1 2011, 50% of countries saw flat or negative growth; a year earlier this applied to only 38% of countries included within the index.

“The efforts on the part of Asian governments to cool house price inflation in the past year have been largely successful, although the latest figures suggest Hong Kong’s housing market is proving less responsive. In Q1 2010 annual inflation stood at 30.4%; this fell to 25.0% in Q2 2010 and 22.1% in Q4 2010 but has now rebounded to 24.2%. Demand from mainland China is a key driver – accounting for nearly one in four Hong Kong property purchases. The Chinese market by comparison has seen annual price growth fall from 49% in Q1 2010 to a more sustainable 8.4%.

“Additional measures are being adopted by the Hong Kong government to curb inflation by launching a new mortgage database. Banks may refuse mortgage applications, lower loan-to-value ratios or offer higher mortgage rates if applicants do not share their mortgage data. Such a move is expected to further suppress speculative activity, as speculators tend not to disclose their mortgage histories as it can limit their ability to own multiple flats.

“Back in Europe, the PIGS economies (Portugal, Ireland, Greece and Spain) are displaying a mixed picture. Spain is still struggling with a significant fall of 2.5% in the last quarter, although this poor performance is overshadowed by Ireland’s 4.5% decline over the same period. Interestingly, Greece and Portugal are showing signs of improvement with prices rising in the last quarter, which is surprising given their economic backdrop.

“The Middle East provides an improving picture. Dubai has seen price growth regain positive territory in the last six months and the consensus is that the market is stabilising following the volatility observed in 2008-2010.

“Israel has consistently been positioned within the top 5-10 rankings in our results table over the past two years. In November 2010, the IMF warned that house prices in Israel were rising unsustainably, with broader risks to the economy. Efforts to curtail inflation resulted in five interest rate rises in the year to March 2011. These efforts seem to have been successful, with Israel recording 1.1% growth in the last quarter, compared with 12.1% annually.

Outlook

“While many housing market experts consider the US to represent the greatest risk to the stability of global housing markets, our view is that Asia still poses something of a threat. There is still a potential in China, Taiwan and in Hong Kong (as highlighted above) for their housing markets to become overheated and bubbles to appear once more, if government intervention proves insufficient.

“In summary we expect to see the current slowdown in global housing markets to continue, hitting a low point in Q4 2011 - assuming the Asian markets continue to cool and the government intervention is successful - but with a slow recovery in global house prices taking place in 2012.”

Knight Frank Global House Price Index, Q1 2011 Results

Courtesy: Knight Frank

For further information, please contact:

Liam Bailey, head of residential research, Knight Frank,

Tel: +44 (0)20 7861 5133, +44 (0) 7919 303148

Email: [email protected]

Kate Everett-Allen, global data coordinator, Knight Frank,

Tel: +44 (0)7876 791630,

Email: [email protected]

Rosie Cade, residential PR manager, Knight Frank,

Tel: +44 (0)20 7861 1068,

Email: [email protected]