UK Property - Country houses show positive price growth across the United Kingdom for the first time in over two years

Quarter 4 results from the Knight Frank Prime Country House Index

Key Highlights:

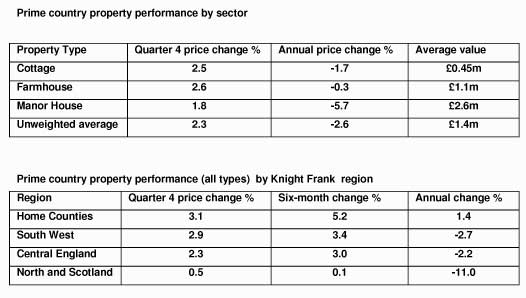

· Prime country house prices rose on average by almost 2.3% in the fourth quarter of the year and are now just 2.6% lower than at the beginning of 2009

· For the first time since autumn 2007 every UK region covered by the index reported a quarterly price increase

· The Home Counties continue to lead the country house market with Q4 growth of 3.1% and annual growth of 1.4%

· A significant imbalance between supply and demand is helping to push prices upwards

Andrew Shirley, Knight Frank’s head of rural property research commented:

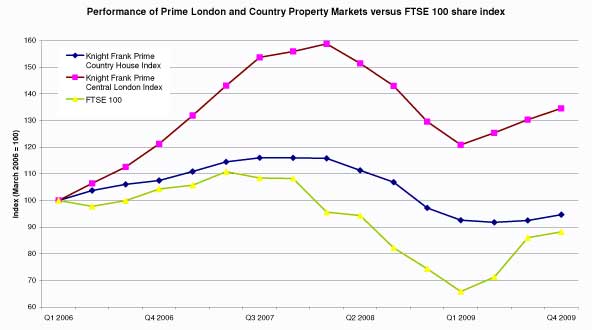

“The price of prime country properties in now increasing across the country as the recovery that started in London during spring 2009 continues to spread further into the regions.

“Overall, prices rose by 2.3% in the final quarter of the year and, on average, are just 2.6% lower than they were at the beginning of the year. An incredible performance considering the general mood of economic gloom that followed the collapse of Lehman’s little more than a year ago.

“Property prices in the Home Counties have shown particular resilience, ending the year 1.4% higher. The north of England and Scotland are recovering more slowly with prices down 11% on an annual basis, but up 0.5% in the last three months of the year.

“There are a number of reasons for this upturn in property prices, but the overriding factor is an imbalance between supply and demand. Across Knight Frank’s network of country offices the number of new potential buyers registering with us increased 50% last year and the number of sales grew 28%. At the same time, however, the volume of available property fell by almost a third. What we are seeing is an increasing number of people competing for a diminishing pool of properties.

“Potential purchasers are more confidence because they feel prices have reached the bottom and are no longer worried about buying into a falling market. The cost of borrowing remains low and credit availability is gradually improving. Around London we are also seeing an increasing number of overseas buyers returning to the market with demand for properties over £5m growing significantly towards the end of the year.”

Rupert Sweeting, Knight Frank’s head of country department said:

“The best properties are now attracting competitive bidding on a regular basis and guide prices are, in many cases, being exceeded with some houses selling for close to what they would have achieved at the peak of the market.

“We are, however, some distance from a return to the headiest days of the property boom when even properties with issues such as road noise would command premium prices. Buyers do remain price sensitive and it is the houses that tick literally every box that are attracting the most competition.

“The question everybody is now asking is how long the recovery can continue and will prices fall again in 2010.

“Currently, we see few signs that stock levels of the best houses will increase markedly in the New Year and the forthcoming general election could exacerbate the situation further. Coupled with the growing number of frustrated buyers looking for houses, this should help to ensure prices do not fall back. The most likely scenario is a levelling off sometime in mid 2010.

“There is speculation that the government’s new bank bonus tax will have an impact on prime property prices, but this has probably been overstated and, regardless, there is still a large pool of UK and overseas buyers whose purchasing power is not reliant on bonuses.”

Courtesy: Knight Frank Residential Research

For further information, please contact:

Andrew Shirley, head of rural property research, Knight Frank,

+44 (0) 207 861 5040, +44 (0) 7500 816 217,

Rupert Sweeting, head of country department, Knight Frank,

+44 (0) 207 861 1078, +44 (0) 7836 260 236,

Davina Macdonald Lockhart, residential pr manager, Knight Frank,

+44 (0) 207 861 1033, +44 (0) 7796 996 154,

About the Knight Frank Prime Country House Index

The Knight Frank Country House Index is a valuation based index, compiled quarterly from valuations prepared by professional staff in every Knight Frank Country House office in the UK. The index is based on the valuation of a comprehensive basket of properties throughout all UK regions based on actual sales evidence.

Knight Frank tracks the performance of three country house property categories; cottages, farmhouses and manor houses. A typical manor house comprises a large property standing in its own, usually extensive, grounds with a private drive. A typical farmhouse has between five and six bedrooms, several acres of land including garden, paddock and barns. A typical cottage has about one acre of land, is detached and has three/four bedrooms. Detailed definitions of the three property types are available on request together with current case studies of properties being marketed.