SA Property – ABSA House Price Indices

House prices remain on a downward trend

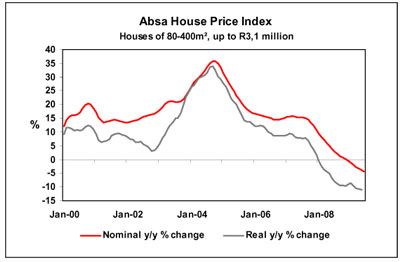

June 2009 saw a continuation of the declining trend in both nominal and real house prices in the South African housing market.

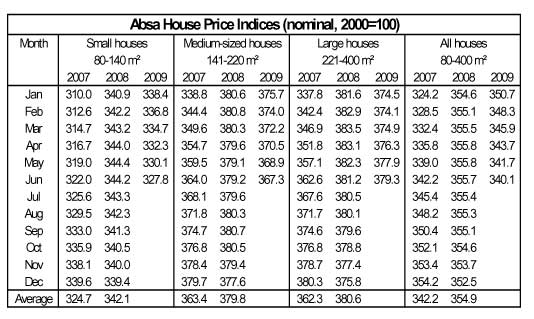

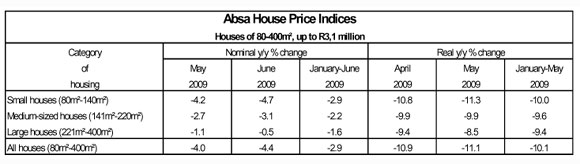

The average nominal price of middle-segment housing (see explanatory notes) was down by 4,4% year-on-year (y/y) to R924 600 in June 2009 (-4,0% y/y in May after revision). This was the biggest nominal price drop since May 1986, when it was -4,3% y/y. On a month-on-month basis, nominal house prices were 0,5% lower in June compared with May. Prices in the middle segment of the market were a nominal R42 700 lower in June 2009, after peaking at R967 300 in May 2008. In real terms, prices were down by 11,1% y/y in May (-10,9% y/y in April), which was the biggest real year-on-year price decline since September 1992.

In the first half of 2009 middle-segment house prices declined by an average of 2,9% y/y in nominal terms, after growing by 6,5% y/y in the first six months of last year. In real terms, house price dropped by an average of 10,1% y/y in the period January-May this year, after declining by 3,3% y/y in the same period last year.

In respect of small houses (80m²-140m²), prices were a nominal 4,7% y/y lower in June this year, after declining by a revised 4,2% y/y in May. The average price of houses in this category was about R653 000 in June. In real terms prices dropped by 11,3% y/y in May (-10,8% y/y in April).

The average nominal price of medium-sized houses (141m²-220m²) declined by 3,1% y/y in June (-2,7% y/y in May after revision), which brought prices in this category of housing to an average of about R917 600, which was R33 600 below the peak of R951 200 recorded in February last year. In real terms, the average price of a medium-sized house was down by 9,9% y/y in May this year.

The average nominal price of large houses (221m²-400m²) was down by 0,5% y/y to about R1 381 700 in June this year, after declining by a revised 1,1% y/y in May. In real terms, the average price of large houses was a real 8,5% y/y lower in May, compared with a decline of 9,4% y/y in April.

The South African economy is firmly in a recession after contracting by a real annualised rate of 6,4% in the first quarter of the year and 1,8% in the final quarter of 2008. Sharp declines were recorded in the real value added in especially the mining and manufacturing sectors in the first quarter, while job losses occur over a wide front in the economy. The economy is forecast to contract by 1,9% for the full year, after growing by a real 3,1% in 2008. It will be the first recession in the South African economy since 1992, when real gross domestic product dropped by 2,1%.

On the back of a nominal 2,9% decline in house prices in the first half of 2009 compared with the same period last year, the average price of houses in the middle segment of the market is back to levels last seen in mid-2007, while in real terms, prices are at their lowest level since mid-2005.

Nominal house price deflation is set to continue for the rest of 2009, starting to slow down towards the end of the year. House prices are forecast to decline by about 3,5% in nominal terms this year after growing by 3,7% in 2008. In real terms prices are set to drop by more than 12,0% this year, taking into account projections for consumer price inflation. This will be the second consecutive year of lower real prices.

The lagged effect of lower interest rates and a gradual recovery in the economy from the second half of the year are factors which will contribute to an expected improvement in residential property market conditions from early 2010.

Courtesy: Jacques du Toit Senior Economist ABSA Bank

Explanatory Notes:

The Absa House Price Indices, available back to 1966, are based on the total purchase price of houses in the 80m²- 400m² size category, priced at R3,1 million or less in 2008 (including improvements), in respect of which mortgage loan applications were approved by Absa. Prices are smoothed in an attempt to exclude the distorting effect of seasonal factors and outliers in the data. As a result, the most recent index and price growth data may differ materially from previously published figures.

Disclaimer:

The information in this publication is derived from sources which are regarded as accurate and reliable, is of a general nature only, does not constitute advice and may not be applicable to all circumstances. Detailed advice should be obtained in individual cases. No responsibility for any error, omission or loss sustained by any person acting or refraining from acting as a result of this publication is accepted by Absa Group Limited and/or the authors of the material.